Streaming Wars: Someone’s bound to win…right?

The search term “Streaming Wars” took off in late 2015 with the near-simultaneous announcements that Hulu (currently owned by The Walt Disney Company) was under consideration for purchase by Time Warner (now owned by WarnerMedia and operating the name WarnerMedia) – who was also investing heavily in the development of HBO Now, the massively successful streaming service.

Despite all of these massive media organization acquisitions and rebrands, the streaming market and war seem more segmented than ever a full five years from the beginning of this so-called war. As developers of back-end video streaming infrastructure – we’re keen to keep an eye on the development of this streaming war and to help enable the next service to join this battle – perhaps even win out a significant part of the market share. As such, we are now evaluating who we believe will be the next “combatant” to earn their stake. Netflix, Amazon Prime, Disney+, and AppleTV+ are not directly addressed as they are currently considered market leaders.

Lords of the Lands

Based on general market data, the following services will not be considered in our list as already hold a considerable portion of the market share:

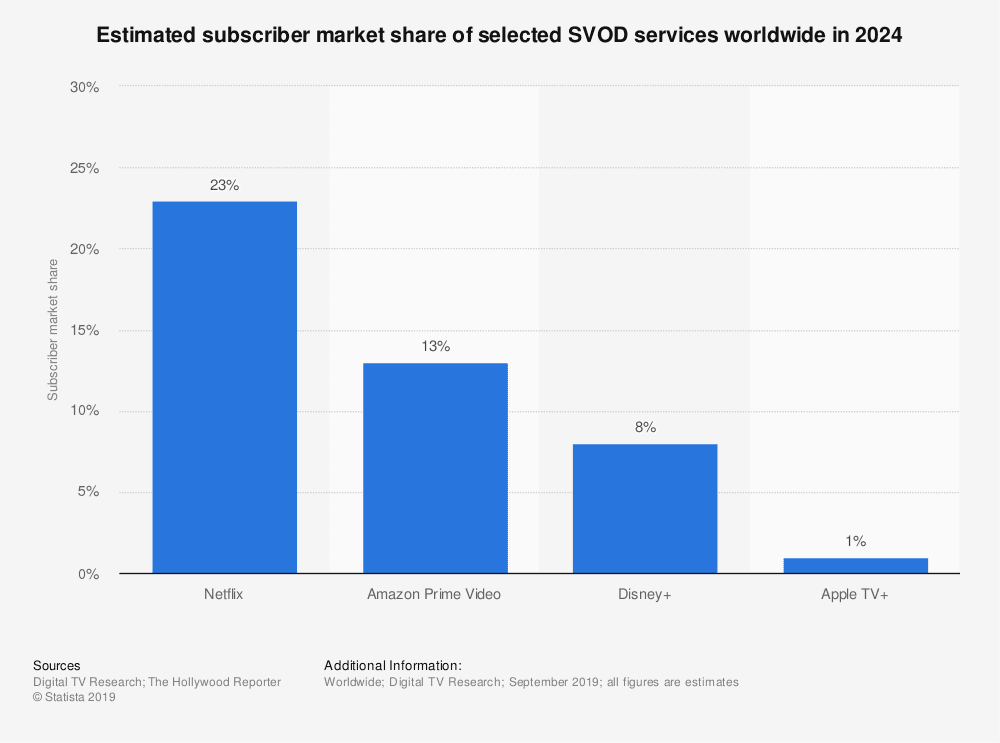

- According to Digital TV Research (via Statista) the current top four SVOD service providers (globally) are Netflix, Amazon Prime, Disney+, and Apple TV+.

- And according to CSI magazine: Joyn, Tubi, Rakuten, Plex, and Hulu/iFlix are the top AVOD-based service providers globally.

2021 Update

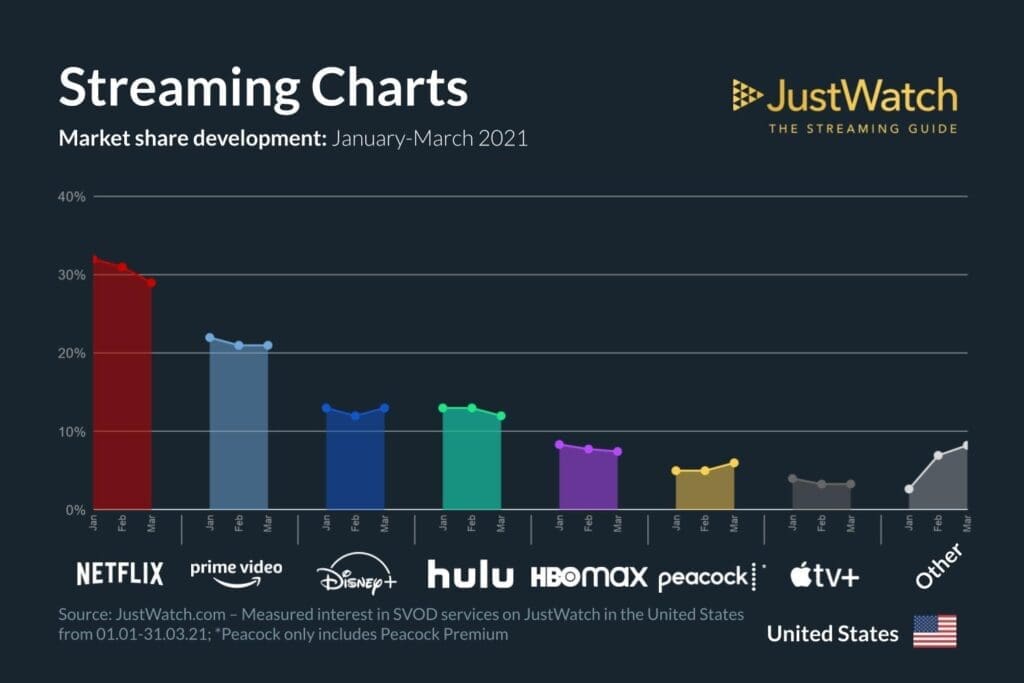

As of Mid-2021, according to JustWatch.com the top 3 SVOD services remained the same in terms of their placement. However, Netflix’s market share grew by 1% since 2020, while Prime and Disney+ saw roughly 6% growth. What’s somewhat unexpected, however, is that Apple TV+ has lost some of its market share to Hulu, HBOMax, and Peacock, and ViacomCBS All Access has not cracked the surface at all!

The OG Model – Subscription-based Streamers Ranked

(1) ViacomCBS: All Access (Superservice)

CBS: All Access, soon-to-be Superservice (name subject to change) will be the next “winner” of the streaming wars as they are using a combination of success factors including using a hybrid monetization model (but more on that in the next post 😉 ). Cost: US$5.99 per month with ads or US$9.99 per month for ad-free streaming.

Pros:

- Viewer Experience (HIGH): Over 30,000 hrs of content from all of Viacom’s networks, such as Comedy Central, Showtime, and countless other regional and national/international content. CBS’s current premium content line-up is headed by their suite of Star Trek original series and Homeland

- Accessibility: All Access is available on nearly every device and application – this also includes casting devices like Chromecast and Amazon Firestick

(2) HBO Max

As predicted, HBOMax cracked the “lords of the SVOD lands”, and currently sits 4th overall in terms of US Market share viewership. HBO Max is in a prime position to hold it’s the top spot and compete with the likes of Netflix, Disney+, Amazon Prime, but there are some steps that WarnerMedia can take to get there…and fast. Cost: US$14.99 per month

Pros:

- Viewer Experience (HIGH): The quality of content that comes with HBO is almost always guaranteed to be high (Game of Thrones, Watchmen, Chernobyl – just to name a few). The quantity of content is a very small question mark, but this should be answered with a well-pointed marketing campaign. HBO Max is paired with some of the best content creators in the world (including all WarnerMedia properties like DCUniverse, which brings an entire library of additional original content)

- Operational Optimization (HIGH): When it comes to streaming high-quality content, WarnerMedia and HBO know who their viewers are and how to best serve them, see how HBO LATAM responded to bandwidth issues in early 2019

(3) Peacock (SVOD Option)

Peacock sits 3rd on this list simply due to its current marketability and its time-to-launch. Which ended being true – as Peacock entered SVOD market with guns blazing and overtook Apple TV+ as major content distributor.

For all intents and purposes, Peacock has as much potential to take the number 1 spot as HBOMax and CBS Superservice alike. With its vast content library and connection to both American and European markets alike (via Sky), Peacock may very well be the dark horse in this battle. We will need to see it after launch to determine it’s value based on Viewer Experience. Cost: US$4.99 per month with ads & $9.99 per month with no ads. Peacock will also offer a free package, which we will address further in our next blog post covering AVOD services.

Pros

- Reach: Two of the biggest consumption markets (excluding APAC)

- Content: Much like Viacom, Peacock is owned by a massive multi-media conglomerate, Comcast, which also owns Sky Media. Peacocks potential for content – live, film, and high quality. However, early reports suggest peacock will only launch with around 7,500 hrs worth of content – lower than the two competitors above. However, an additional pro is the original content Peacock/Comcast is teasing to launch in 2021.

(4) YoutubeTV

YouTubeTV is no more as of late 2020, Alphabet abolished its SVOD plans and sold off much of its content to the likes of Netflix. It’s current focus has shifted towards live-streaming of premium content, such as sports.

Youtube has the reach, it has the modularity and the audience, but the cost of service is a major minus point. Consumers will be hard-pressed to choose YoutubeTV over any of the other streaming services or standard cable. It’s also important to note that YoutubeTV has been progressively (and frequently) hiking the price of this SVOD service.

Pros

- Huge audience potential

- Very modular and customizable play options

- Well established and implemented technology

- New Tech innovations

Price, Content Quality and Quantity are the winning weapons

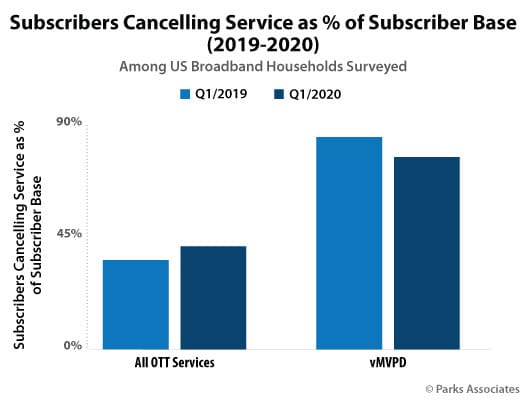

According to a graphic (see below) by research firm Parks Associates, countless SVOD services are seeing uncharacteristically high churn rates – with some services reporting nearly a 45% churn rate.

Deadline media suggests that this is likely due to a combination of factors, namely free trial expirations and lack of sustained new content. Although this report mostly focused on the top four streaming services not examined today, it should act as a warning for the ranked service providers moving forward – to retain customers and reduce churn your service must find an equal balance between costs and new content. With cord-cutting at an all-time high, consumers are seeking to save on costs compared to cable, instead of adding so many services that their total costs exceed cable.

In short, determine a favorable cost, and keep viewers engaged with a rich library of content – something ViacomCBS (CBS All Access), WarnerMedia (HBO Max), and NBCUniversal (PeacockTV) are aggressively pursuing

Our next blog post will cover the side of the video streaming coin Ad-based services (AVOD) – which some industry experts believe will be the ultimate winners of the Streaming Wars as they only charge in time and attention as opposed to $$$.